Insurance Telematics overview

Usage-Based Insurance (UBI) is a type of vehicle insurance that monitors driver behavior and milage, through which, insurers can align premium rates according to the driver’s actions, type of driving, or distance traveled. But, how to choose the ideal solutions for insurance telematics?

There are two main models of UBI. PAYD (Pay As You Drive), which uses mileage driven as the main parameter for premium calculation, therefore, in some cases is also known as Pay Per Mile (PPM), and PHYD (Pay How You Drive), which uses the Driver behaviors as the main metric for price calculation. Additionally, Behavior-Based Insurance (BBI) is gaining popularity. Programs using this model focus more on measuring the driver rather than the vehicle, and this is mostly accomplished via smartphone-based solutions.

UBI has been around for two decades now, from the first pilot projects in the USA in the late ’90s, to some European insurers using the model in the early 2000s, however, these first attempts were not deployed on a large scale due to vulnerabilities on the solutions or technical limitations.

Modern technology grants precise vehicle usage measurement by using accurate tools like the GPS, and multiple sensors from both the vehicles, and external devices. This has allowed the insurance industry to develop more complex premium-schemes taking into count not only mileage traveled, but also advance driving behavior, speed, geographical areas, types of road, or times of day when a vehicle is used.

Data Collection

Insurance Telematics relies on various sources for data collection, being OEM’s Connected-vehicles systems, Smartphone sensors, and Aftermarket telematics devices the main ones.

In recent years, smartphone-based UBI solutions have gained popularity, as they are the most cost-effective solution for insurers, as they eliminate additional hardware expenses of fitting a telematics device into the vehicle. Unlike GPS-tracking devices, through smartphones, the insurers can also measure distracted driving, by detecting mobile phone usage while the driver is behind the wheel.

On the other hand, smartphones are not necessarily a substitute for vehicle-installed telematics devices, as people might leave their phone at home, decide to turn it off, or run out of battery.

Aftermarket telematics devices (Black boxes), like OBD dongles, Windscreen tags, or Battery-mounted trackers, provide more consistent and high-quality data, and also allow reliable crash detection, and in some cases, accident reconstruction.

Market situation

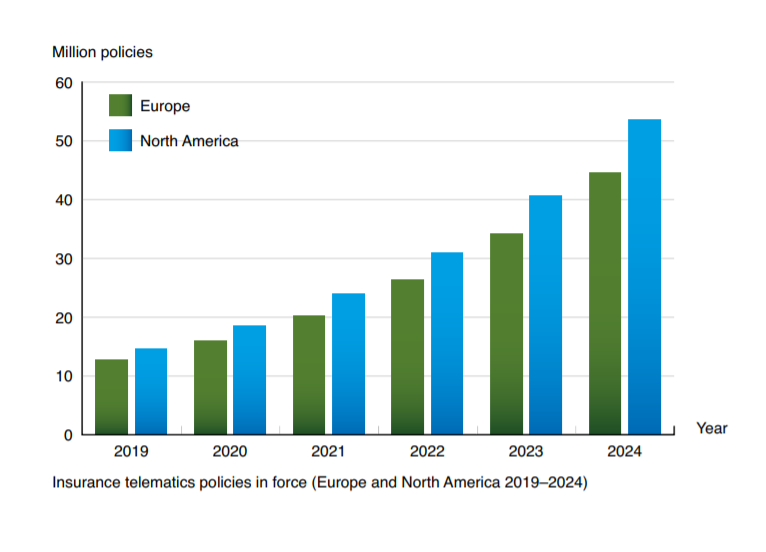

According to the latest research report on Insurance Telematics in Europe and North America from the firm Berg Insight, this segment is at the moment in a period of strong growth and is expected to accelerate shortly until reaching around 100 million insurance telematics policies by the end of 2024.

The number of active insurance telematics policies in North America is estimated to be 14.7 million at the end of 2019 and forecasted to reach 53.6 million by 2024, which represents a compound annual growth rate (CAGR) of 29.6 percent. In Europe, the estimated active insurance telematics policies reached 12.8 million by the end of 2019 and are expected to have a compound annual growth rate of 28.2 percent, to reach 44.5 million by 2024.

Historically speaking, countries like the USA, Canada, Italy, the UK, and Germany have been the markets concentrating the vast majority of active insurance telematics programs, however, other countries around the globe are starting to adopt such schemes.

Berg Insight report brochure on Insurance Telematics in Europe and North America http://www.berginsight.com/ReportPDF/ProductSheet/bi-insurancetelematics5-ps.pdf

Telematics devices and UBI programs not only allow the insurance sector to better analyze the vehicle and driver data but opens the door to finally make the switch to digital insurance. It makes it much easier for insurance companies to offer additional services like road assistance, stolen vehicle recovery, or build an entire ecosystem to cross-sell other non-vehicle insurance products to their customers.